In today’s digital age, e-commerce has become a thriving industry, allowing businesses to reach a global audience and consumers to enjoy the convenience of shopping from the comfort of their homes. However, with this rapid growth comes the need for regulations to ensure fair and secure transactions for both businesses and consumers. In this comprehensive guide, we will explore the various e-commerce regulations that online businesses need to be aware of to operate legally and successfully.

1. Consumer Protection Laws

Consumer protection laws play a crucial role in e-commerce, as they aim to safeguard the rights and interests of online shoppers. These laws vary from country to country, but they generally cover areas such as product safety, accurate product descriptions, fair pricing, and transparent refund and return policies. Online businesses must comply with these regulations to build trust with their customers and avoid legal consequences.

2. Privacy and Data Protection

With the increasing amount of personal data being collected by online businesses, privacy and data protection have become major concerns for consumers. E-commerce regulations often include provisions for data protection, requiring businesses to implement secure systems and obtain consent from users for collecting and using their personal information. It is essential for businesses to understand and comply with these regulations to maintain the trust of their customers and avoid data breaches.

3. Intellectual Property Rights

Intellectual property rights, such as trademarks, copyrights, and patents, are crucial for protecting original creations and innovations in the e-commerce industry. Online businesses must respect these rights and avoid infringing on the intellectual property of others. This includes using copyrighted images, selling counterfeit products, or using trademarks without permission. Understanding and abiding by intellectual property regulations is essential for long-term success in the e-commerce industry.

4. Online Advertising and Marketing

E-commerce regulations also extend to online advertising and marketing practices. Businesses must ensure that their advertising is truthful, not misleading, and does not violate any laws or regulations. This includes disclosing sponsored content, avoiding deceptive advertising practices, and adhering to specific regulations for industries such as healthcare and finance. Staying up to date with advertising regulations is crucial to maintaining the trust of consumers and avoiding legal issues.

5. Cross-Border Regulations

As e-commerce allows businesses to operate globally, it is important to understand the cross-border regulations that apply to online transactions. These regulations may include customs duties, import/export restrictions, tax requirements, and product labeling standards. Online businesses must navigate these regulations to ensure compliance and avoid delays or penalties when selling internationally.

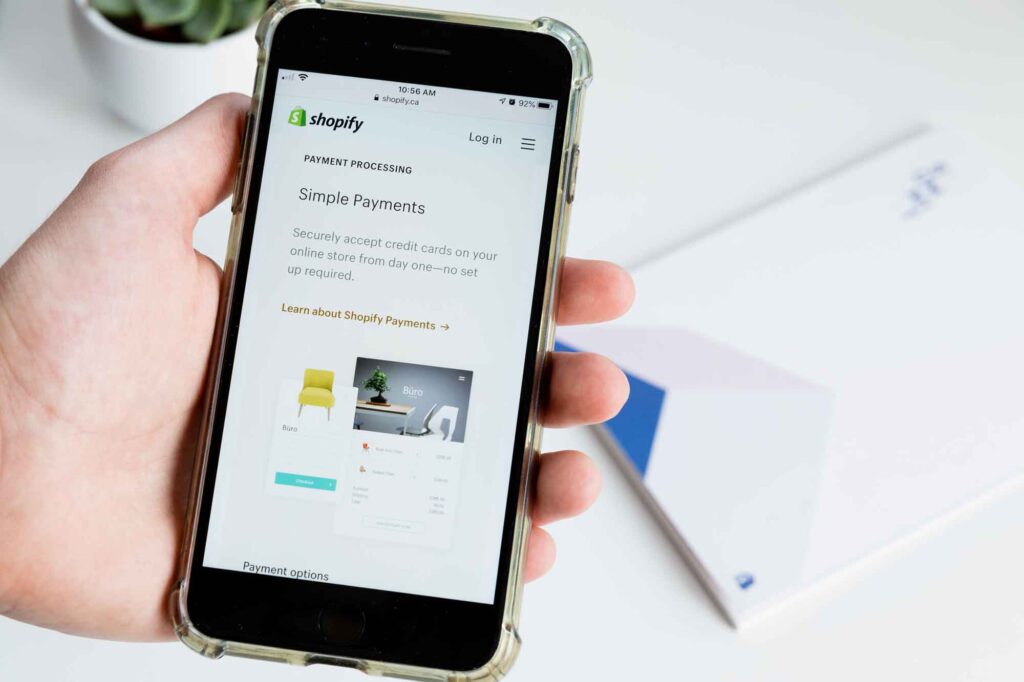

6. Payment Processing and Security

One of the key aspects of e-commerce regulations is ensuring secure payment processing. Online businesses must comply with Payment Card Industry Data Security Standard (PCI DSS) requirements to protect customer payment information. Additionally, regulations may require businesses to offer secure payment options, implement fraud prevention measures, and adhere to specific guidelines for storing and transmitting customer data.

7. Accessibility and Usability

Inclusivity and accessibility are important considerations in e-commerce regulations. Businesses must ensure that their websites and online platforms are accessible to individuals with disabilities, providing equal opportunities for all users. This includes complying with accessibility standards, such as the Web Content Accessibility Guidelines (WCAG), and making necessary adjustments to accommodate different needs.

8. E-commerce and Taxation

Taxation is a complex aspect of e-commerce regulations, as online businesses may be subject to different tax laws depending on their location and the jurisdictions they operate in. This includes sales tax, value-added tax (VAT), and customs duties. Online businesses must understand and comply with the tax regulations applicable to their operations to avoid penalties and legal issues.

9. Dispute Resolution and Consumer Complaints

E-commerce regulations often include provisions for dispute resolution and handling consumer complaints. Online businesses should have clear policies and procedures in place to address customer concerns and resolve disputes in a fair and efficient manner. This may involve offering refund or return options, providing customer support channels, or participating in alternative dispute resolution mechanisms.

10. Staying Updated and Compliant

E-commerce regulations are constantly evolving, and it is crucial for online businesses to stay updated with the latest developments. This may involve regularly reviewing and updating policies and procedures, seeking legal advice when needed, and staying informed about industry best practices. By staying compliant with e-commerce regulations, businesses can build trust, protect their reputation, and thrive in the competitive online marketplace.

Conclusion

Navigating e-commerce regulations is essential for online businesses to operate legally, protect consumer rights, and ensure secure transactions. By familiarizing themselves with the various regulations discussed in this guide and staying updated with the latest developments, businesses can establish a strong foundation for success in the e-commerce industry.

Key Takeaways

- Consumer protection laws are vital for online businesses to build trust and avoid legal consequences. Compliance with regulations on product safety, accurate descriptions, fair pricing, and transparent refund policies is crucial.

- Privacy and data protection regulations require businesses to implement secure systems and obtain user consent. Adhering to these regulations helps maintain customer trust and prevents data breaches.

- Intellectual property rights must be respected to avoid infringement. Understanding and complying with trademark, copyright, and patent regulations are essential for long-term success.

- Online advertising and marketing practices should be truthful and comply with laws and regulations. Staying updated with advertising regulations is crucial to maintaining consumer trust and avoiding legal issues.

- Cross-border regulations, including customs duties, import/export restrictions, and tax requirements, must be navigated when selling internationally.

- Secure payment processing is crucial, with businesses needing to comply with PCI DSS requirements and implement fraud prevention measures.

- Accessibility and usability regulations ensure equal opportunities for all users. Compliance with accessibility standards is important for inclusivity.

- Understanding and complying with tax regulations applicable to e-commerce operations is crucial to avoid penalties and legal issues.

- Clear policies and procedures for dispute resolution and handling consumer complaints are necessary to address customer concerns efficiently and fairly.

- Staying updated and compliant with evolving e-commerce regulations is essential for building trust, protecting reputation, and thriving in the competitive online marketplace.

To further enhance your understanding of e-commerce regulations and ensure compliance, consider enrolling in the Parsons Ecommerce Foundations online course and certificate program offered by Yellowbrick. This comprehensive program will provide you with valuable insights and practical knowledge to navigate the complex landscape of e-commerce regulations successfully.